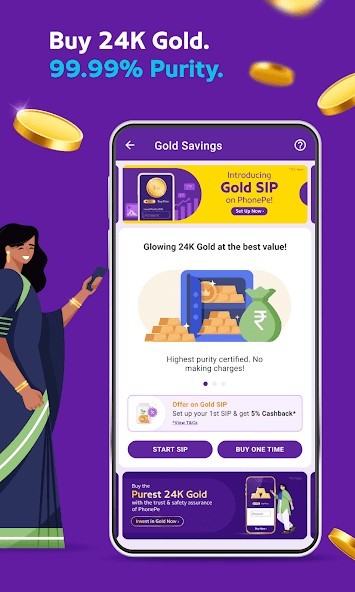

PhonePe UPI, Payment, Recharge

Rating: 0.00 (Votes:

0)

PhonePe is a payments app that allows you to use BHIM UPI, your credit card and debit card or wallet to recharge your mobile phone, pay all your utility bills and to make instant payments at your favourite offline and online stores.

You can also invest in mutual funds and buy insurance plans on PhonePe. Get Car & Bike Insurance on our app.Link your bank account on PhonePe and transfer money with BHIM UPI instantly! The PhonePe app is safe and secure, meets all your payment, investment, mutual funds, insurance and banking needs, and is much better than Internet banking.

Things you can do on PhonePe (Phonepay) App:

Money Transfer, UPI Payment, Bank Transfer

- Money Transfer with BHIM UPI

- Manage Multiple Bank Accounts – Check Account Balance, Save Beneficiaries across multiple bank accounts like SBI, HDFC, ICICI & 140+ banks.

Make Online Payments

- Make online payment on various shopping sites like Flipkart, Amazon, Myntra etc.

- Pay for online food orders from Zomato, Swiggy etc.

- Pay for online grocery orders from Bigbasket, Grofers etc.

- Pay online for travel booking from Makemytrip, Goibibo etc.

Make Offline Payments

- Scan and Pay via QR Code at local stores like kirana, food, medicines etc.

Buy or Renew Insurance Policies with Insurance App

- Term Life

- Hospital Daily Cash Insurance: Cover of up to Rs. 4.5L for hospitalization expenses

- Dengue & Malaria Insurance: Get covered for 6 mosquito-borne diseases for as low as Rs. 49/year

- Coronavirus Insurance: Stay protected against COVID-19 related hospital expenses

- Domestic Multi-Trip Insurance: Stay secure every time you step out of your home

- International Travel Insurance: Secure your next international trip in seconds!

- Bike Insurance: Protect your 2-wheeler against damages, accidents and financial losses with PhonePe bike Insurance app

- Personal Accident Insurance: Insure yourself against accidents & disablement

- Car Insurance: Protect your car against damages, accidents and financial losses with PhonePe car Insurance app

Use the PhonePe app for all your insurance related needs.

Mutual Funds App and Investments App

- Liquid Funds Investment: Get higher returns than your savings bank account

- Tax Saving Funds: Save up to Rs. 46,800 in tax & grow your investment

- Super Funds: Achieve your financial goals with expert help on our investment app

- Equity Funds Investment: High growth products curated as per your risk appetite

- Debt Funds: Get stable returns for your investments without any lock-in period

- Hybrid Funds investment: Get a balance of growth and stability

- Buy or Sell 24K Pure Gold: Get assured 24K purity & build your gold savings on our investment app

Recharge Mobile, DTH

- Recharge Prepaid Mobile Numbers like Jio, Vodafone, Idea, Airtel etc.

- Recharge DTH like Tata Sky, Airtel Direct, Sun Direct, Videocon etc.

Bill Payment

- Pay Credit Card Bills

- Pay Landline Bills

- Pay Electricity Bills

- Pay Water Bills

- Pay Gas Bills

- Pay Broadband Bills

Buy PhonePe Gift Cards

- Buy a PhonePe Gift Card for easy payments across 1 lakh+ leading offline and online outlets and across the PhonePe app.

Manage your refunds

- Manage and track refunds from your favorite shopping websites on PhonePe.

For more details, please visit our website at https://www.PhonePe.com

Permissions for App and reasons

SMS: to verify Phone number for registration

Location: a requirement by NPCI for UPI transactions

Contacts: for phone numbers to send money to and numbers to recharge

Camera: to scan QR code

Storage: to store scanned QR code

Accounts: to pre-populate email ID while signing up

Call: to detect single vs dual sim and let user choose

Microphone: to carry out KYC video verification

User ReviewsAdd Comment & Review

Based on 0

Votes and 0 User Reviews

No reviews added yet.

Comments will not be approved to be posted if they are SPAM, abusive, off-topic, use profanity, contain a personal attack, or promote hate of any kind.

Other Apps in This Category